Solid-state batteries for electric vehicles: Still in R&D or on the verge of commercialization?

Solid-state batteries (SSBs) have gained in importance in recent years and almost all well-known OEMs mention the technology on their development roadmaps, sometimes with quite specific dates for their implementation. But have SSBs already reached the necessary technological maturity for introduction in the automotive market? Alongside the manufacturers' commercialization announcements, there are still reports from research and development that suggest that there are still major challenges on the road to mass production.

Despite the promising prospects of SSB technology, only a few solid-state battery cells have been commercialized. The challenges lie not only in the material and cell concepts themselves, but especially in the production processes, some of which differ significantly from those of conventional lithium-ion batteries.

In this blog post, we provide an overview of the industrial landscape for solid-state batteries. In addition, we identify different technology variants of the key industry players. Finally, we derive insights from industry roadmaps and production expansion plans to illustrate the current state and future prospects of solid-state battery technology.

Overview of players involved with solid-state batteries

SSB technology is expected to be used primarily in the automotive industry. Several major players have already announced their intention to use SSB technology. BMW, for example, plans to use solid-state batteries from 2030, Mercedes by 2030, Ford from 2028 and Toyota from 2027. Hyundai also has similar plans and is aiming to integrate this technology by 2030. In so-called "semi-solid" concepts, SSB cells are set to come onto the market even earlier.

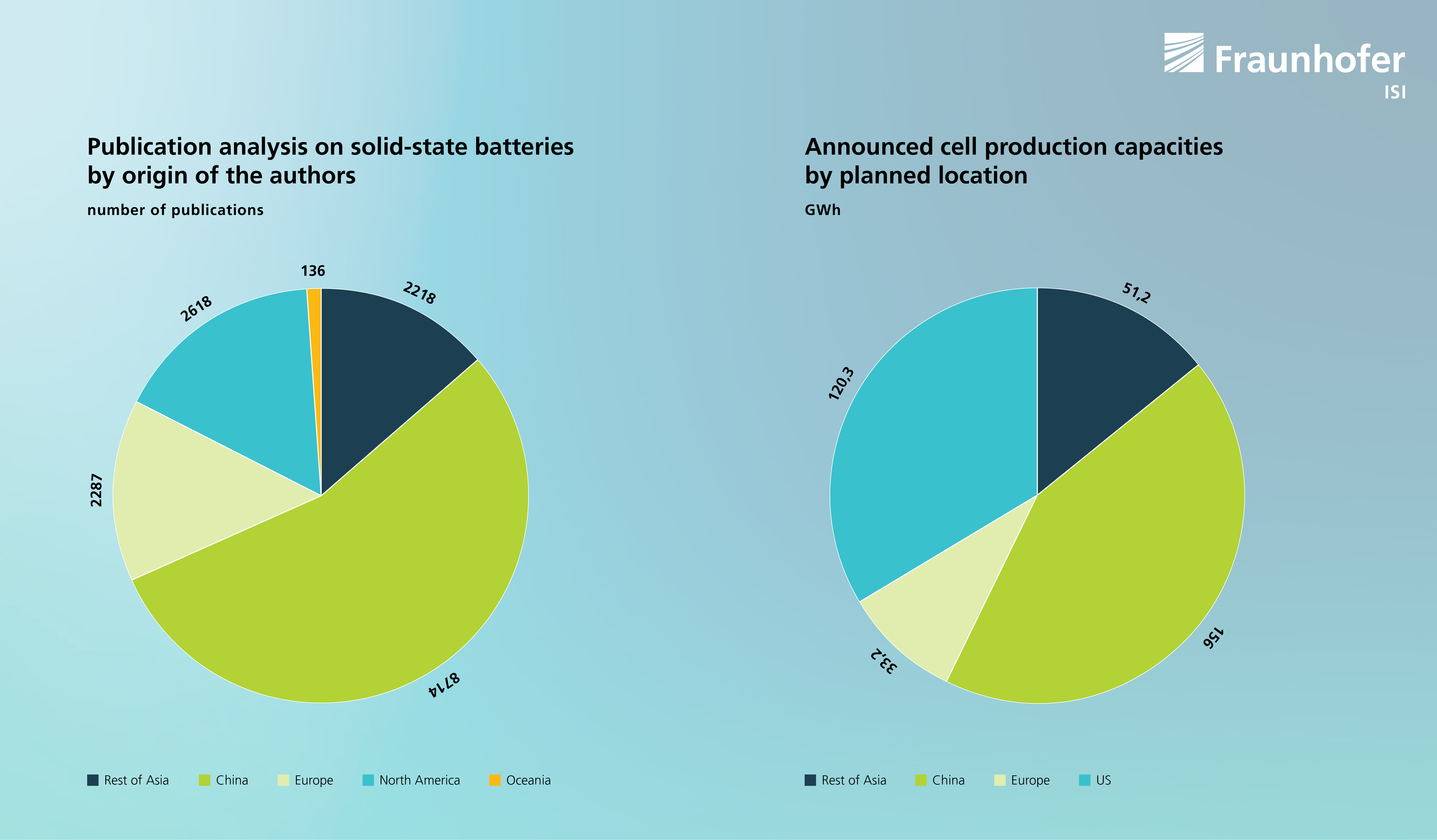

The research and development of SSB batteries is currently dominated by China. A quick look at the publications of the last five years that mention the term "solid state batteries" reflects this. The number of publications comes mainly from Chinese authors (55%), followed by North America (16%), Europe (14%) and Asia (14%).

Similar trends can be seen in the announced SSB production. Among the companies that have already announced production volumes up to 2030 are names such as WeLion, Solid Energy Systems, Blue Solutions, TDK, Pro Logium and Gangfeng. The announced production is clearly dominated by China, followed by Europe, Asia and the USA.

Other companies have also declared their intention to participate in the production of solid-state batteries in the coming years, but have not announced exact dates. These include large companies such as AESC (until 2027), LGES (from 2030), Samsung SDI (from 2027), SVOLT (until 2030) and Lition (from 2025). However, some start-ups in Europe such as LionVolt (from 2025), LeydenJar (from 2026) and Morrow Battery (from 2030) are also represented. In North America, Hydro Quebec (from 2025), Ionic Materials and Prieto Battery are already active in this area from this year, as are EnPower GreenTech (from 2025) and Solid Ultrabattery (from 2025).

Technology variants of solid-state batteries

The concepts developed for solid-state batteries are as diverse as their manufacturers. This is due to the fact that there are a very large number of possible combinations of anodes, solid electrolytes and cathode concepts. Although research and development has been underway for several years, the diversity of technology variants has hardly been consolidated to date.

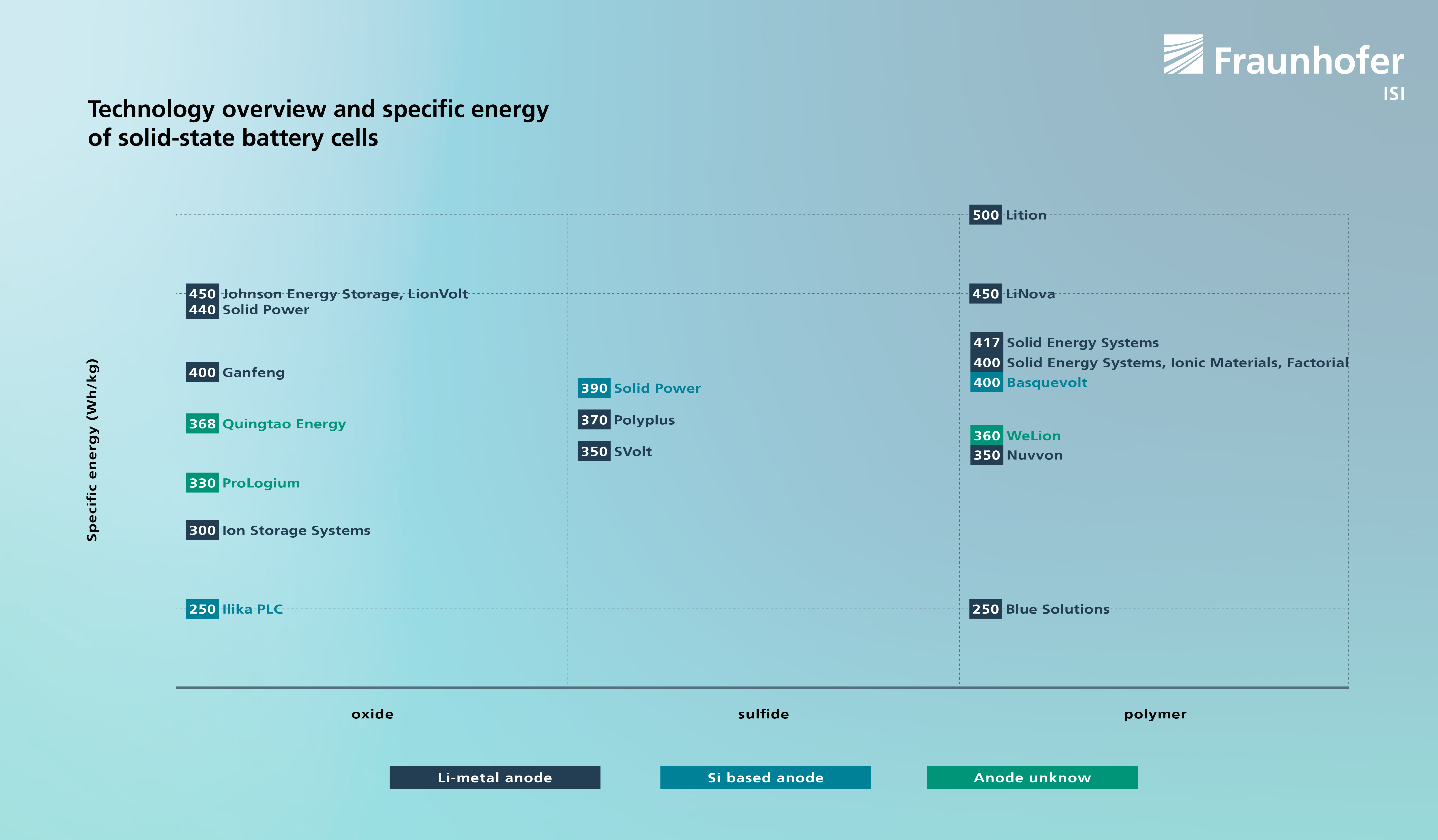

Differences lie in the use of different anode active materials, including lithium metal anodes and silicon-based anodes, as well as in the use of cathode materials (LFP, NMC). Among the solid electrolytes that are currently considered promising are polymer, sulphide and oxide electrolytes, which have different properties in terms of ionic conductivity and chemical stability.

With the exception of some cell variants based on polymer electrolytes, no clear difference has yet been identified in the level of technology maturity achieved. Some developers have so far presented large-format and multi-layer cells (suitable for electric vehicles). However, the first giga-commercial implementation in the field of electromobility is only emerging for semi-solid concepts or is still in the process of being developed.

The energy density achieved by solid-state batteries depends on the technologies used in the anode, cathode and electrolyte. This is not only due to the different specific weights of the solid electrolytes (oxides, for example, are quite heavy, while polymer-based materials are rather light), but is always the result of the overall cell design, e.g. the thickness of the separator and the electrode layers, the filling percentage of the catholytes and, in particular, the anode concept used. Figure 2 shows the planned specific energy of SSB-cells of several manufacturers. Depending on the selected technology, the values are around 400 Wh/kg.

How will solid-state batteries develop in the future?

Companies such as ProLogium from Taiwan have been announcing their intentions to mass-produce solid-state batteries since 2021. The goal was to enter the market by 2023. Although a production capacity of 1-2GWh was planned for 2022, the opening of a giga-scale solid-state factory in January 2024 indicates a delay of around 1-2 years.

The picture is similar for US companies such as Quantumscape and Solid Power. Quantumscape originally planned to reach a production capacity of 1GWh by 2024, increasing to 20GWh by 2026. However, recent reports indicate that initial low-volume pilot production is not planned until the end of 2024, and large-scale production is not scheduled to begin until 2025.

Similarly, Solid Power announced in 2021 that production of a first industrial line would begin in early 2026 and mass production of solid electrolytes would begin as early as 2023. Mass production of SE is now not expected to start until 2026. Despite the announcement of further pilot lines from 2025, industrial production does not yet appear to be fully realized.

The roadmap for the broader introduction of SSB batteries in electric vehicles therefore remains speculative and must now be further developed by the companies from the products demonstrated so far and suitable for automotive use to production.

The data used in this article comes from the BEMA2020 research project, which was funded by the German Federal Ministry of Education and Research (grant number 03XP0272B).

![BMBF_CMYK_Gef_M [Konvertiert]](/en/blog/themen/batterie-update/feststoffbatterien-elektro-autos-kommerzialisierung-stand-forschung-entwicklung/jcr:content/fixedContent/pressArticleParsys/textwithasset_208279_1003605373/imageComponent/image.img.jpg/1715673768755/BMBF-gefoerdert-2017-en.jpg)