Competitive market for battery materials: Market leaders, technologies and cost analysis

The market for lithium-ion battery materials is rapidly evolving worldwide. What the USA and the EU are doing to counter China’s dominance and why overcapacity does not necessarily ensure secure supply chains.

To meet the growing demand, e.g. for electric vehicles, the production of lithium-ion batteries (LIB) and the corresponding supply industry have expanded significantly in recent years. Innovations, particularly in materials, are driving further development with a focus on improving energy density and reducing costs. Changes in production and supply chain strategies are influencing the market. Innovations in LIB materials play a crucial role in improving the performance of battery cells, thereby supporting the global transition of mobility toward electrified transportation. The question remains whether China can maintain its leading position in the market in the face of increasing competition.

Anode Materials: Challenges and Perspectives in the Use of Graphite and Silicon

Although lithium metal offers the highest theoretical capacity for anodes, its practical application is still hindered by several challenges: The formation of dendrites during charging and discharging poses a significant risk of short circuits and cell defects.

Additionally, the anode undergoes substantial relative volume changes during the cycle, leading to structural instability that affects both the performance and safety of the battery. Another issue is the unstable Solid Electrolyte Interphase (SEI), which also degrades over time.

For these reasons, the use of lithium-metal anodes in commercial applications remains problematic. To address these issues, structurally stable graphite, which accounts for about 90 to 95 percent of current applications is predominantly used despite its relatively low capacity. Current research focuses on improving the specific capacity of graphite while maintaining its structural stability.

In addition, silicon is also used for anodes (with a market share of five to ten percent). This material is expected to be used in an increasing number of batteries in the future, as it can incorporate significantly more lithium into the anode matrix compared to graphite, thus storing more energy. However, the significant volume expansion of silicon during material cycling causes severe issues such as the detachment of the anode from the current collector or separator, which in turn negatively affects battery performance and lifespan.

To overcome the potential risks of silicon anodes and benefit from their superior capacity, the use of graphite-silicon composite anodes represents a significant improvement. This approach can help regulate the volume expansion of silicon. Another viable solution, as recent studies suggest, could be the carbon coating of silicon anodes.

Cathode Materials: From NMC and NCA to LFP

The capacity of a battery is significantly limited by the cathode materials, which can incorporate and release fewer lithium ions during cycling compared to anode materials. The most important active cathode materials currently in commercial use include lithium nickel manganese cobalt oxide (NMC), lithium iron phosphate (LFP), lithium manganese oxide (LMO), lithium nickel cobalt aluminium oxide (NCA) and lithium cobalt oxide (LCO). These materials differ in terms of cost, energy density and lifespan.

NMC cathodes were originally developed to overcome the structural instability of LCO cathodes at high charge states by partially replacing cobalt in LCO with nickel and manganese. This ultimately resulted in a higher energy density for the material.

An alternative to NMC, which exhibits very similar performance parameters, is NCA. In 2024, approximately 70 percent of the demand for cathode batteries in the electric vehicle market was for nickel-based cathodes such as NMC and NCA. However, due to market volatility, ethical concerns related to nickel mining (particularly cobalt mining) and the manufacturing challenges associated with Ni-based cathodes, LFP has emerged as a much more promising candidate for the future.

LFP offers significantly better cycle performance and is more cost-efficient. However, the material has, on average, only 70 percent of the energy density of Ni-based cathodes. Recent advancements, such as Cell-to-Pack (CTP) technology, have significantly improved the energy density of LFP at the pack level. Additionally, the production of LFP cathodes is supported by local governments in China due to their environmentally sustainable supply chain. These governments provide financial incentives, such as tax breaks, subsidies, land grants and logistical support to attract and support battery manufacturers and raw material suppliers. The global demand for LFP is not limited to the electric vehicle market but is also attributed to stationary energy storage applications.

Why China Leads the Battery Materials Market

In recent years, China has taken a leading role in the production of key materials for lithium-ion batteries including anodes, cathodes, electrolytes and separators. The success of Chinese companies is largely attributed to China’s long-standing industrial policies, initiated over 15 years ago through strategic programs such as the "Made in China 2025" campaign. These policies fostered consistent growth and technological advancements, securing China’s leadership in the industry and enabling the establishment of numerous companies that have since achieved global success.

Additionally, there are well-established supply relationships between Chinese material suppliers and Chinese LIB cell manufacturers such as CATL and BYD. These partnerships are characterized by long-term, mutually beneficial agreements.

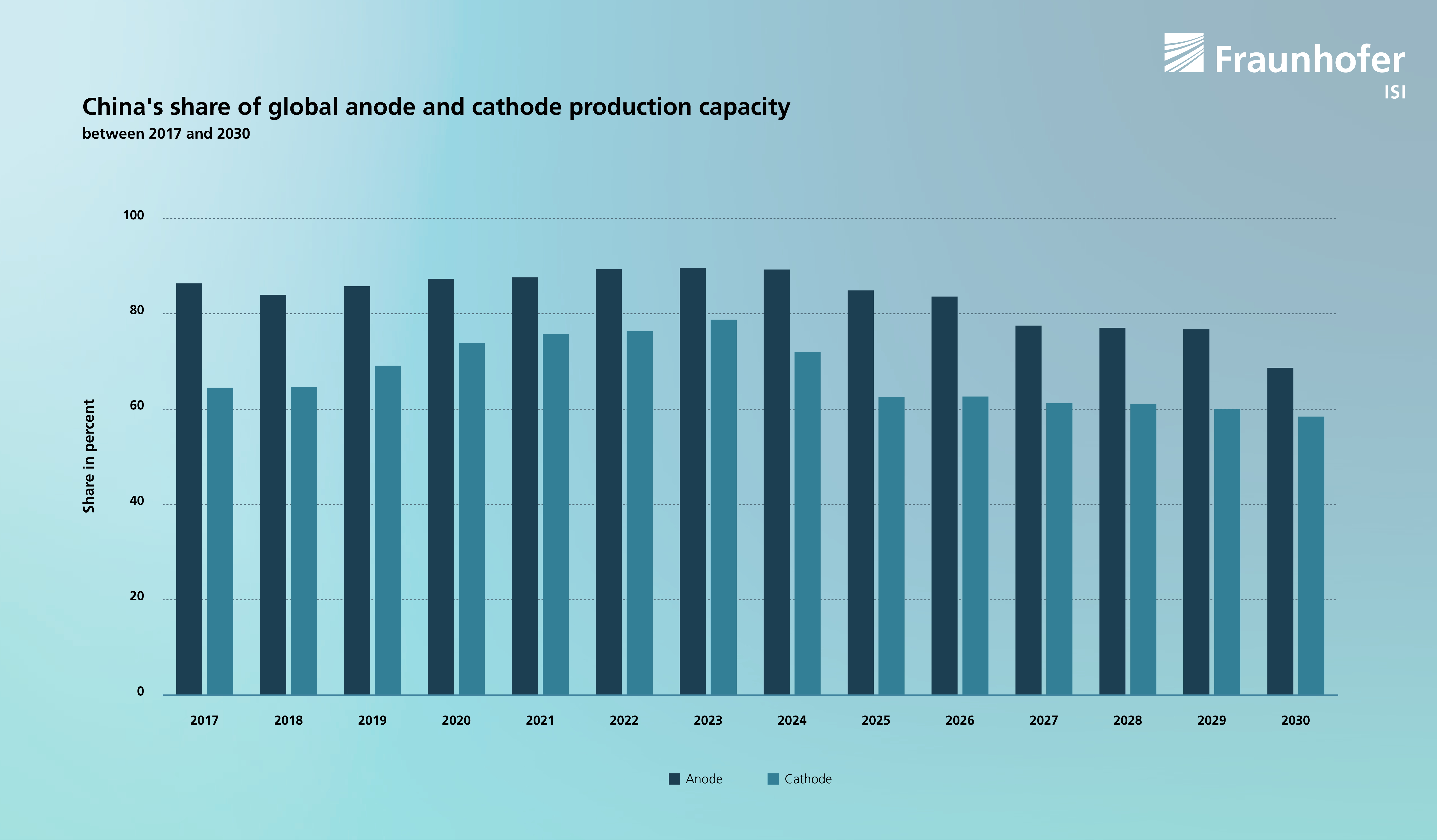

Between 80 and 90 percent of anode materials on the global market have been manufactured in China in recent years. The share of cathodes was between 70 and 75 percent, for electrolytes between 85 and 90 percent and for separators between 55 and 60 percent. Figure 1 illustrates China’s percentage share of global battery materials production over the years. Although China’s market share may decrease in the coming years due to increased investments from the USA and the EU, the country is likely to maintain its position as a key player in the battery materials market.

The Chinese manufacturer BTR New Energy Material currently leads the global market for anode materials with a market share of approximately 22 percent. This leading position is attributed to its high level of research and development and numerous production facilities, not only in China but also abroad. In August 2024, the company launched its new plant for LIB anode materials in Indonesia, which has become the largest anode production facility outside of China.

Shanghai ShanShan ranks second in the global market with a share of around 19 percent. The rising demand for batteries and the insufficient supply in Europe compared to competitors have provided Chinese companies with opportunities for further expansion. By the end of 2023, ShanShan invested €1.3 billion in a new anode material plant in Finland, which is expected to achieve an annual production capacity of 100,000 tons of synthetic graphite.

Jiangxi Zichen Technology, another Chinese company, ranks among the top three manufacturers with a 10 percent market share. The company stands out for its pioneering role in high-quality synthetic graphite and advancements in silicon-based anode materials, which have been developed over years of research in collaboration with the Chinese Academy of Sciences.

China Shifts Strategy in Cathode Material Production

Although NMC currently has the highest market demand, China has shifted its focus to producing LFP due to its lower cost, improved safety and greater environmental compatibility. Currently, LFP dominates the Chinese market for cathode materials with a market share of approximately 60 to 70 percent. This strategy has resulted in increased production capacities, intensified competition and significantly reduced battery costs, but it has also led to overcapacity in the market.

The Chinese company Hunan Yuneng is at the forefront of the overall production of cathode material with a share of around nine percent and an expected production capacity of around 893,000 tons of LFP by 2025. This is followed by the Chinese manufacturers Dynanonic with a market share of seven percent and XTC New Energy Materials with six percent. The distribution of production shares in the cathode material market is relatively fragmented. The specific types of cathode materials produced by these companies vary, as each employs different technologies and chemical compositions.

In the electrolyte production market, Chinese manufacturers such as Shenzhen Capchem, Tinci, Kaixin and Guotai-Huarong have established themselves as leading producers. In the production of separators, the industry is dominated not only by Chinese companies such as Shanghai Energy New Materials, but also by companies such as Asahi from Japan and SKIET (South Korea).

The USA and Europe Respond to China's Dominance in Battery Production

China's prominent advances in battery materials production have prompted the EU and US to step up efforts to develop local supply chains and expand battery manufacturing capacity.

The US Department of Energy (DOE), under the framework of the Inflation Reduction Act (IRA) has committed $3 billion to support battery manufacturing and materials production, aiming to fortify the domestic supply chain. This funding will be directed towards expanding US battery manufacturing capacity, refining critical minerals and enhancing battery component recycling to foster a more sustainable and resilient supply chain. Joint ventures between various American carmakers and in particular Korean ones are examples of domestic efforts to reduce dependence on international sources and strengthen local battery production.

On Europe’s side, investments and regulations are also being made to reduce the reliance on outsourcing for European battery manufacturers and EV producers. A key step in this effort is the European Critical Raw Materials Act, which regulates critical and strategic raw materials essential for green and digital technologies as well as for defence and space.

Impact of the Critical Raw Materials Act on Battery Manufacturing in Europe

The Act sets benchmarks to strengthen domestic capacities along the strategic raw material supply chain by 2030: 10 percent of the EU's annual needs for extraction, 40 percent for processing and 25 percent for recycling. Additionally, it aims to limit dependence on a single third country to no more than 65 percent of the EU's annual needs for each strategic raw material at any relevant stage of processing.

In line with these goals Vianode, a Norwegian company focused on sustainability, opened its first anode production plant in October 2024. With an initial investment of NOK 2 billion (around €1.7 billion), Vianode aims to become a leading anode manufacturer by producing graphite anodes for up to 20,000 electric vehicles annually with up to 90 percent lower CO2 emissions compared to standard materials. A second plant is planned with the goal of increasing annual production capacity to supply anode materials for up to 2 million electric vehicles by 2030.

Global Overcapacity in Battery Materials Does Not Guarantee EU Supply Chains

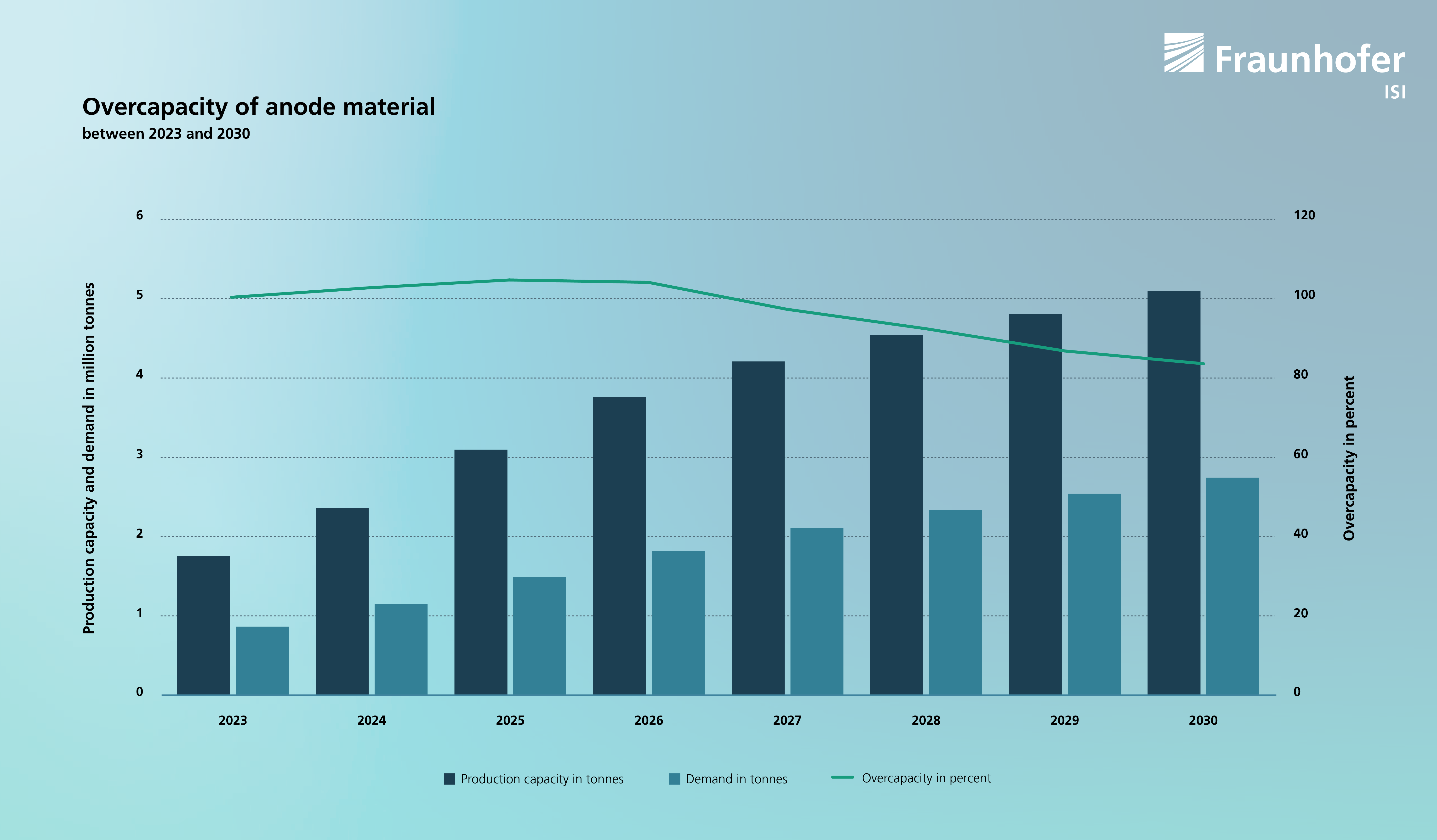

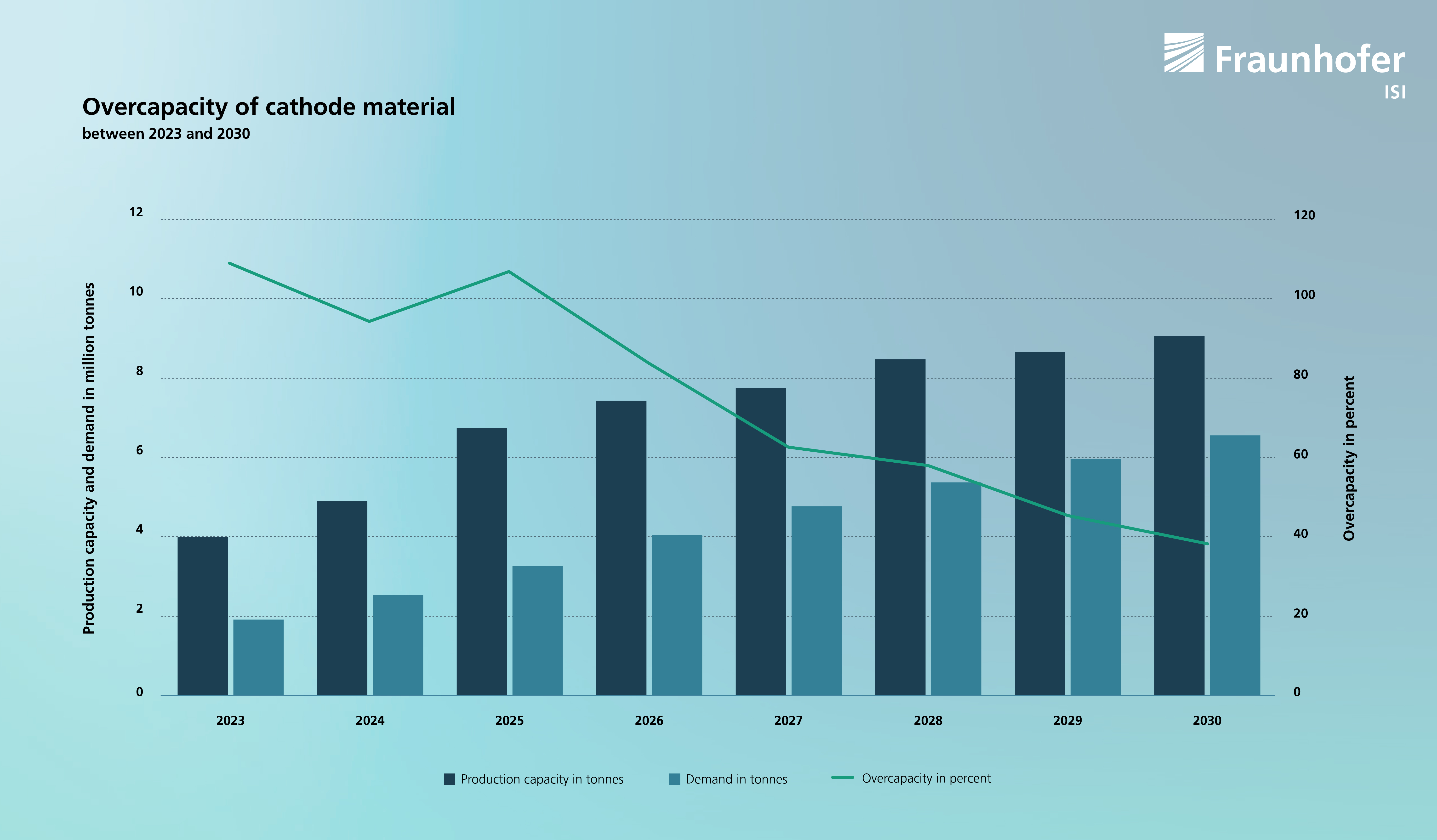

Over the coming years global overcapacity in material production is expected. This is driven by aggressive investments and production expansions, particularly in China, aimed at dominating the global supply chain. Meanwhile, the EU and USA are working to reduce import dependencies and establish local production capacities. Estimates of anode and cathode overcapacities by 2030 are illustrated in Figures 2 and 3.

Although global shortages in battery materials are unlikely, securing a reliable supply chain may still be challenging for European and North American manufacturers due to the dominance of Chinese companies.

China has reinforced its position by securing long-term contracts with mining companies in resource-rich regions such as South America, Africa and Australia. Major Chinese mining and battery companies have heavily invested in both raw material extraction and refining, ensuring control over critical materials like lithium, cobalt and nickel.

Geopolitical tensions and national interests could further complicate supply chains. For example, starting in December 2023, China restricted exports of certain graphite products. Such measures could impact material availability for Western manufacturers and undermine their competitiveness in the electric vehicle market.

Prices for Battery Materials: Past, Present and Future

Prices for anode materials have dropped significantly. In 2010, a ton cost approximately $15,000, but today prices have fallen to $8,000–$8,500 per ton. This decrease is attributed to improved production methods and scaled-up manufacturing. While further price reductions are expected, they are likely to slow down: projections estimate that anode prices could reach around $7,500 per ton by 2030. Currently, with demand exceeding 1,100 kilotons, annual revenues for anode manufacturers amount to nearly $9 billion.

Cathode materials remain the most expensive component in battery production. In 2010, cathode materials cost over $34,000 per ton. Thanks to production advancements and a shift to cheaper iron-based materials, prices have declined to $20,000–$25,000 per ton. In 2022 and 2023, there was an increase in costs due to rising raw material prices, particularly for lithium and nickel. The price of cobalt is also highly volatile.

While further price reductions are anticipated, the pace is expected to slow, with estimates suggesting cathode prices could drop to $15,000–$20,000 per ton by 2030. As cell production drove demand to over 2,800 kilotons annually in 2024, the cathode material market reached a volume of $55 billion.

Electrolyte prices are more stable. For years, they have hovered around $8,000 per ton and no significant changes are expected in the near future. In 2024, the annual demand for electrolytes reached approximately 700 kilotons, corresponding to a market value of about $5.5 billion.

Separator films are measured not only by weight but also by surface area. Their price has fallen from nearly $3/m² in 2010 to less than $1/m² today. This price momentum is expected to level off in the foreseeable future. Currently, total demand for separators exceeds 200 kilotons, giving this segment a market value of approximately $5 billion.

The data used in this article comes from the "BEMA On" (grant number 03XP0621A) research project, which is funded by the German Federal Ministry of Education and Research.