Alternatives to lithium-ion batteries: potentials and challenges of alternative battery technologies

The growing global demand for batteries is currently covered for the largest part by lithium-ion batteries. However, alternative battery technologies are increasingly coming into focus due to geopolitical dependencies and resource availability. What alternatives to lithium-ion batteries can meet the growing demand, ease the raw material situation and reduce geopolitical dependencies? How can supply chains be established in such a way that a resilient and technologically sovereign battery ecosystem can be created in Europe? And what about sodium-ion batteries, already used in electric vehicles in Asia?

The current annual demand for lithium-ion batteries (LIB) is around 1 TWh. Market forecasts predict global demand of 2 to 6 TWh by 2030, with up to 10 TWh being considered realistic in the long term. The increase will be driven in particular by the switch from combustion engines to electric vehicles. Electric cars already account for the largest share of battery demand at more than 70 per cent, and a significant increase in demand is also expected in the future due to the electrification of (light) commercial vehicles. In addition, demand for batteries will also increase in other established areas of application, e.g. in the power grid, as well as in new areas of application (e.g. flight applications such as drones).

A resilient and technologically sovereign battery ecosystem in Europe requires access to supply chains and thus raw materials and components, as well as cell production capacities. Current strategies to reduce dependencies on raw materials - e.g. by mining lithium in Europe, expanding recycling capacities and reducing waste during production - may reduce existing dependencies in the future, but can only partially solve the problem, especially in view of the significant increase in demand. Alternative battery technologies can help here. This reduce geopolitical dependencies due to their materials and supply chain structure and ideally achieve technological, ecological and/or economic advantages at the same time.

Properties of alternative battery technologies

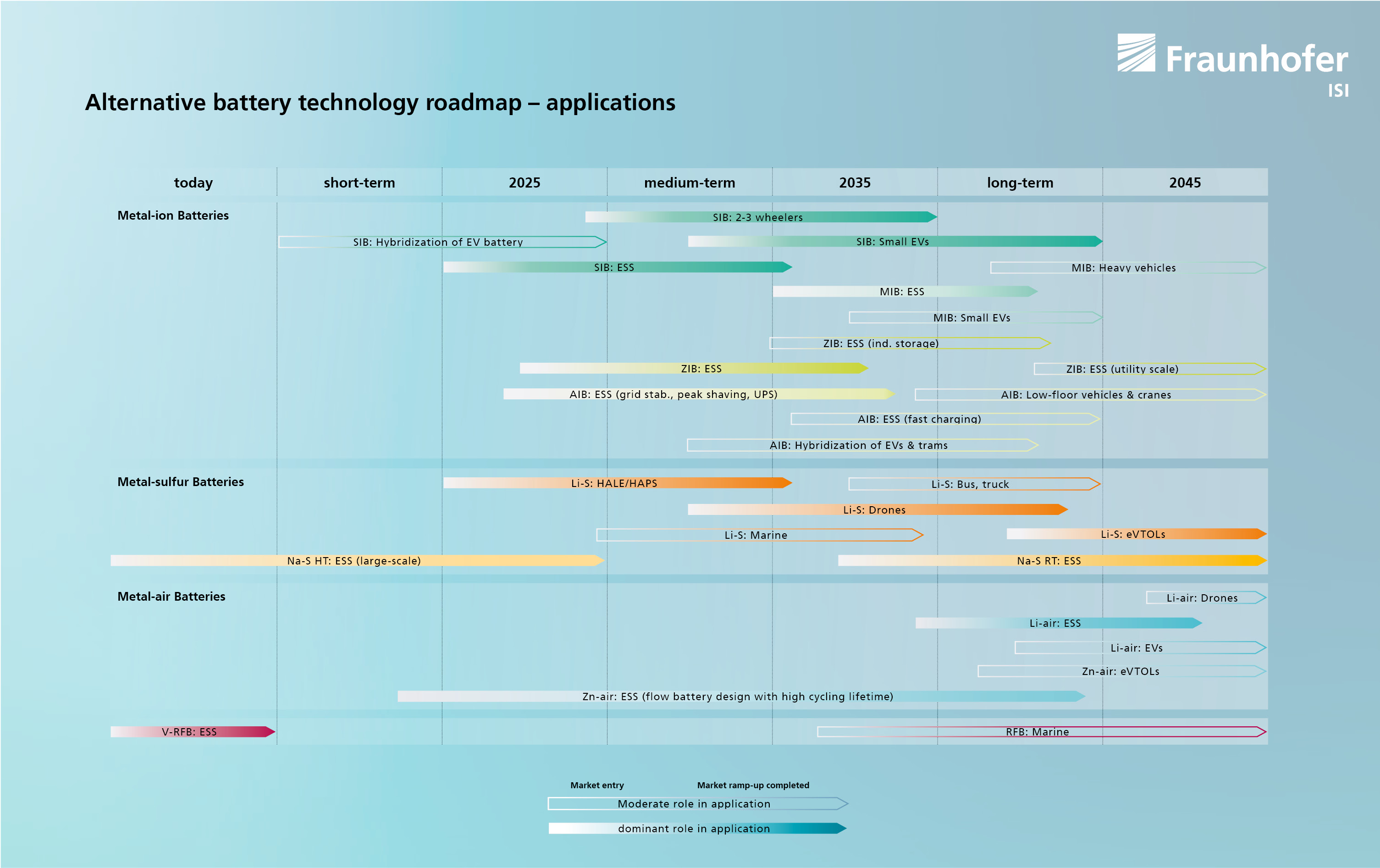

A roadmap published by Fraunhofer ISI in autumn 2023 examines the role that alternative battery technologies - i.e. non-LIB-based battery technologies - can play from a technical, economic and ecological perspective for the period up to around 2045. The focus here is on battery technologies that are predominantly still in the development stage and are therefore not yet widespread on the market. In particular, these are promising metal-ion, metal-sulphur, metal-air and redox flow batteries.

The various battery technologies differ, for example, in their structural design (e.g. a gas diffusion electrode in metal-air batteries) and in the materials used (e.g. sodium or zinc instead of lithium). However, changes in structure or material pose a variety of challenges: from suitable active materials and electrolytes with high kinetics and stability to scalable production processes and end-of-life strategies.

Alternative battery systems are therefore characterised by various technical advantages and disadvantages. For example, sodium-ion technologies have lower energy densities than LIB. Other promising technologies such as lithium-sulphur batteries can have higher gravimetric energy densities than LIBs, but are relatively large (lower volumetric energy density) and also manage fewer cycles.

Development status and potential of individual alternative battery technologies

The technologies under consideration differ significantly in terms of their technological maturity, market potential and possible sustainability benefits (Figure 1). Some of the technologies, such as high-temperature sodium-sulphur and redox flow batteries, are very advanced and are already in use, while others are still in the early stages of development and research is focussed on developing a functioning cell design.

However, less developed battery technologies such as zinc, magnesium or aluminium-ion batteries, sodium-sulphur RT batteries or zinc-air batteries also have high potential, particularly due to the availability of relevant resources in Europe. However, most of the alternative battery technologies considered have a lower energy density than lithium-ion batteries, which is why a larger quantity of raw materials is typically required to achieve the same storage capacity.

Patent and publication analyses indicate that Europe is relatively better positioned for the development of some alternative battery technologies than it currently is for LIBs, such as redox flow batteries, lithium-air and aluminium-ion batteries. Nevertheless, Japan and China remain the leading nations in terms of patent and publication activities.

When and in which applications could alternative battery technologies come onto the market

The different levels of technological maturity and the technological challenges mean that the alternative battery technologies are likely to be ready for market entry at different times. In addition, the alternative battery technologies are suitable for different applications due to their technical properties, e.g. energy density or service life.

Figure 2 shows when and in which application a battery technology could come onto the market. For example, sodium-ion batteries could be increasingly used in mobility applications (especially small cars) in the near future, lithium-sulphur in smaller flight applications (e.g. drones) in the medium term and sodium-sulphur or zinc-ion batteries in stationary applications.

However, none of the technologies analysed have the same range of applications as lithium-ion batteries. Accordingly, it can be assumed that LIBs will continue to dominate the market in the future. The alternative battery technologies can supplement or even replace LIBs in individual applications and thus make the battery market more diverse.

Sodium-ion battery as a promising technology

The sodium-ion battery in particular is looking especially promising - the industry has also picked up speed here in recent months. For example, Chinese battery manufacturer CATL announced the production of sodium-ion batteries for Chery models back in spring 2023. At the beginning of January 2024, the new Yiwei brand of the Chinese JAC Group presented the world's first mass-produced compact electric vehicle with sodium-ion batteries from battery manufacturer HiNa; a second model should follow shortly from the Chinese company JMEV with batteries from Farasis Energy. In Europe, the Swedish manufacturer Northvolt developed a sodium-ion battery for stationary use in November 2023, with mobile applications to follow.

Due to their relatively low energy density, sodium-ion batteries can be used as an alternative to lithium iron phosphate (LFP) batteries. Compared to LFP batteries, they have a slightly lower energy density and cycle life, but offer advantages in terms of greater safety and better performance at cold temperatures. They can also be cheaper than LIBs and the raw material sodium is more readily available than lithium. Another advantage is that they are a "drop-in" technology, i.e. existing production facilities can be utilised and production capacity can be ramped up quickly.

How to build a sustainable battery ecosystem

In addition to overcoming technical hurdles for many of the alternative battery technologies under consideration, a resilient and technologically sovereign battery ecosystem must be established. Among other things, the availability of raw materials, production capacities, supply chains and recycling must be taken into account. The simplest approach would be to build on existing production lines and supply chains. The development of new supply chains is only realistic for technologies with special use cases, especially those with a sufficiently high demand in the medium to long term. Political incentives can be helpful here, especially in the initial phase when future market development is still uncertain.

The data used in this article comes from the BEMA2020 research project, which is funded by the German Federal Ministry of Education and Research (grant number 03XP0272B).

![BMBF_CMYK_Gef_M [Konvertiert]](/en/blog/themen/batterie-update/alternative-batterie-technologien-lithium-ionen-potenziale-herausforderungen/jcr:content/fixedContent/pressArticleParsys/textwithasset_208279_712579364/imageComponent/image.img.jpg/1669109419622/BMBF-gefoerdert-2017-en.jpg)