Battery recycling in Europe continues to pick up speed: Recycling capacities of lithium-ion batteries in Europe

The recycling of lithium-ion batteries (LIB) will play a central role for Europe in the future. Both expansion projects and announcements of new recycling plants can currently be observed. This blog post is an update of an article from July 2023 and looks at the latest developments.

Update: A new version of this article was published in July 2025 with updated information and data.

In addition to waste management, the reduction of import dependencies for raw materials and the reduction of the environmental impact of battery production are crucial for LIB recycling capacities in Europe. Statutory collection and recycling quotas, the expansion of the European battery industry and the production scrap in cell manufacturing are further stimulating the development of the recycling industry. End-of-life (EoL) traction batteries, which currently still often come from pilot and test vehicles, are also contributing to this. In particular, the EoL return volumes of traction batteries after eight to 15 years show that the development of recycling capacities is taking place with a time delay to the market ramp-up of the battery industry and electromobility.

Current and announced recycling sites for lithium-ion batteries in Europe

The interactive map in Figure 1 shows the recycling plants in Europe with corresponding capacities for lithium-ion batteries that are expected to be installed by the end of 2024 and those announced for the coming years, as well as their operators. In particular, the announcements relate to maximum capacities that are named. The particularly high number of recycling sites in Central Europe is striking. However, more capacities are also being announced in Eastern Europe.

Proximity to battery material producers, battery cell producers or car manufacturers is a recognizable driver for the selection of recycling infrastructure locations, e.g. in central and eastern Germany, Hungary, northern France or on the Scandinavian coast. Many plants are being planned from pilot projects or smaller plants with expansion stages. The former, such as Cylib or Tozero, are mostly university-based start-ups. For the latter, there are already established companies such as Northvolt, SungEel HighTech and EcoBat, some of which are planning to expand the recycling capacity of their sites by more than 100 kilotonnes of processing capacity per year by 2030. Car manufacturers such as Mercedes-Benz with Licular, whose recycling site is licenced in Kuppenheim (Southwest Germany), are expanding their own spoke and hub recycling capacities close to their production networks.

Figure 1: Existing and announced recycling sites for lithium-ion batteries in Europe (as of June 2024)

Recycling facilities can be divided into »spokes« and »hubs« according to the depth of recycling, i.e. the input and output materials of the recycling process. The first steps of battery recycling, known as pre-treatment, take place mainly in the spokes. Here the used batteries are collected, discharged, dismantled and mechanically or by pyrolysis processed into the so-called black mass (a mixture of cathode and anode active materials) with the valuable metals such as Li, Ni and Co.

The actual recycling and refinement of the raw materials occurs in the hubs. Here, the black mass is refined using pyro- or hydrometallurgical processes or electrochemical processes, whereby valuable metals such as Li, Ni and Co are recovered. However, other less valuable but critical raw materials such as graphite or manganese are now also being included in the focus of the recovery process

Individual recycling projects include both pretreatment (spoke activity) and refinement (hub activity) at one location. These are labelled »spoke+hub« in the diagram, whereby the processing capacity corresponds to the maximum total quantity on the site per year.

Overall, battery recycling is very diverse and can be carried out using different process combinations - there is no ‘one’ recycling route. In Europe, hydrometallurgy is clearly emerging as the core process in the hubs. Pyrolysis is only occasionally used in pre-treatment or pyrometallurgy as a sub-process in refinement, e.g. at Umicore or Nickelhütte Aue.

Spokes are typically decentralised arranged to facilitate optimal collection logistics, whereas hubs for processing the black mass are often situated centrally and well connected in terms of infrastructure. This approach is partly also driven by the fact that the transportation of lithium-ion batteries is classified as dangerous goods, which is a costly endeavour. Yet conversely, the onward transportation of the black mass to the hubs is not a significant concern.

In Europe, the cumulative capacities of the hubs (status 2024: approx. 350 kt/a) currently exceed the capacities of the spokes (status 2024: approx. 300 kt/a). The current capacities of integrated recyclers (spoke and hub activities at one location at the same time) only amount to a few tens of kilotonnes per year. At first glance, the absolute number of hubs exceeds the number of spokes. Nevertheless, numerous hub activities represent either the installation or proclamation of capacity expansions of pre-existing facilities. Almost every player in European battery recycling is planning to set up several sites for its recycling activities.

Recycling capacities for lithium-ion batteries in Europe will increase to 330,000 tonnes per year by 2026

Information on the capacity of most recycling plants is publicly available. However, as not all plants have the same recycling depth, it is not possible to simply add these capacities together. The capacities for spokes and hubs can be added up separately, which provides an estimate of the total recycling capacities in Europe. Plants that cover all process steps are included in both the spoke and hub capacity accumulation. The capacities do not reflect the actual reserved capacities, but the publicly reported maximum capacity of a location.

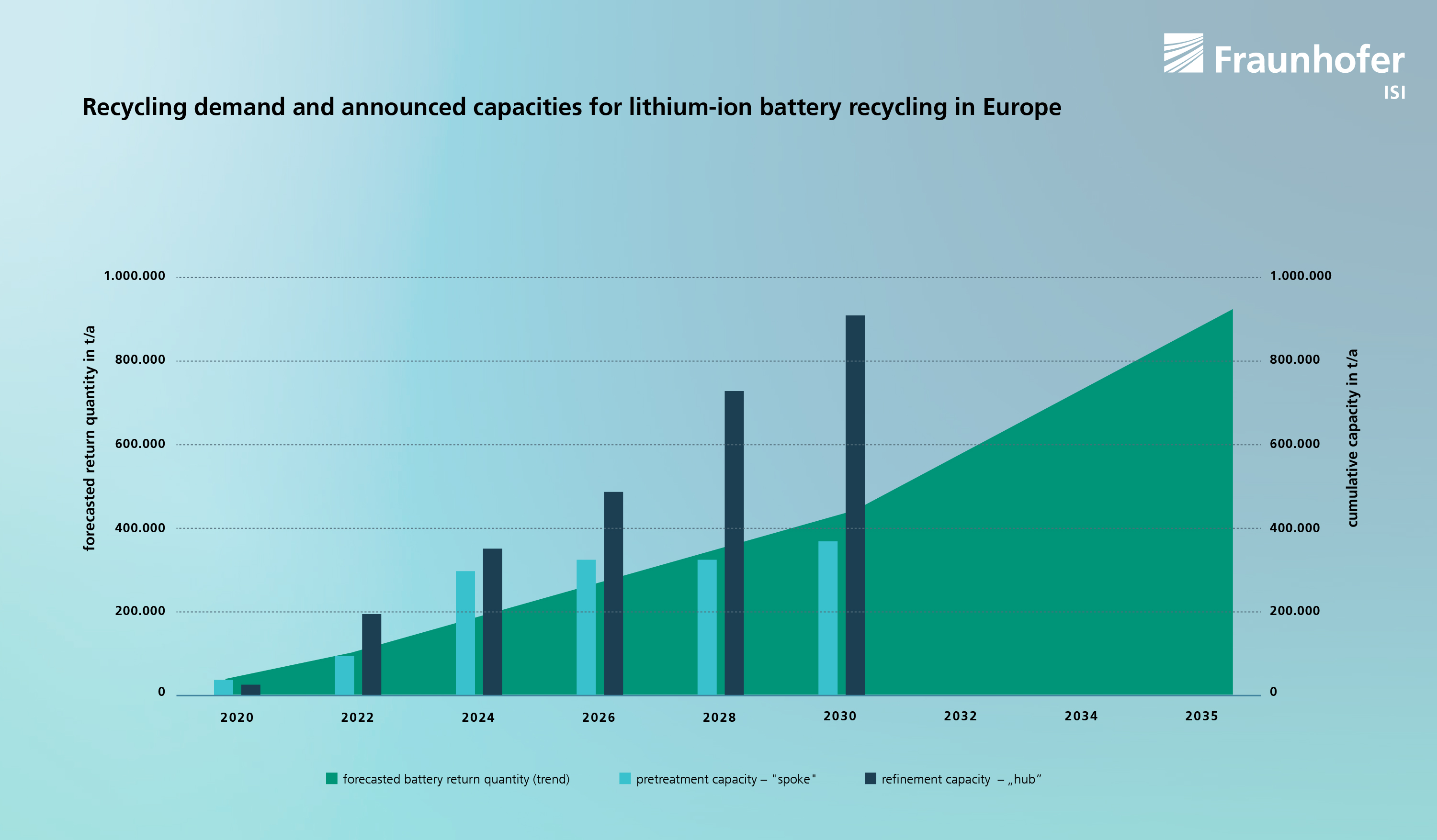

In Europe, the total capacity of spokes for LIB recycling is expected to increase to 300,000 tonnes per year by the end of 2024. This already includes capacities that have been announced for this year, but have not yet been officially commissioned. Compared to 2023, this is almost a doubling of capacities (160,000 tonnes by the end of 2023), not least due to the announcements of Li-Cycle in Magdeburg, Eramet in Dunkirk and Re.Lion.Bat in Meppen with a cumulative capacity of 100,000 tonnes in 2024. With announced additional plants and expansions, capacities in Europe are expected to reach 330,000 t/a in 2026. By 2030, almost 370.000 t/a in pretreatment capacity has been announced.

After 2024, the announced capacities for recycling the black mass in hubs will also increase significantly. By 2030, the total capacity for material recovery would be 900 kt/a, almost double the pretreatment capacity. Whether and to what extent the import of black mass as feedstock for material recovery will play a role is still unclear.

A comparison of the planned recycling capacities with the forecast return volumes of recycled batteries and production scrap (the projected return volume in 2026 is approx. 270,000 tonnes per year) indicates that the cumulative planned capacities will exceed supply in the coming years (Figure 2).

The high market momentum in Europe is driven by the establishment of battery cell production sites, among other things: This is because, particularly during the ramp-up phase, but also during ongoing operations, relevant quantities of production waste are accrued that need to be recycled. For example, SungEel HighTech is installing its new recycling plant for the utilisation of production waste not far from the LG Chem cell production facility in Wroclaw, Poland. A slowdown in the expansion of cell production capacities could therefore also delay the establishment and expansion of recycling capacities.

European companies dominate battery recycling competition in the EU - but Asian players are catching up.

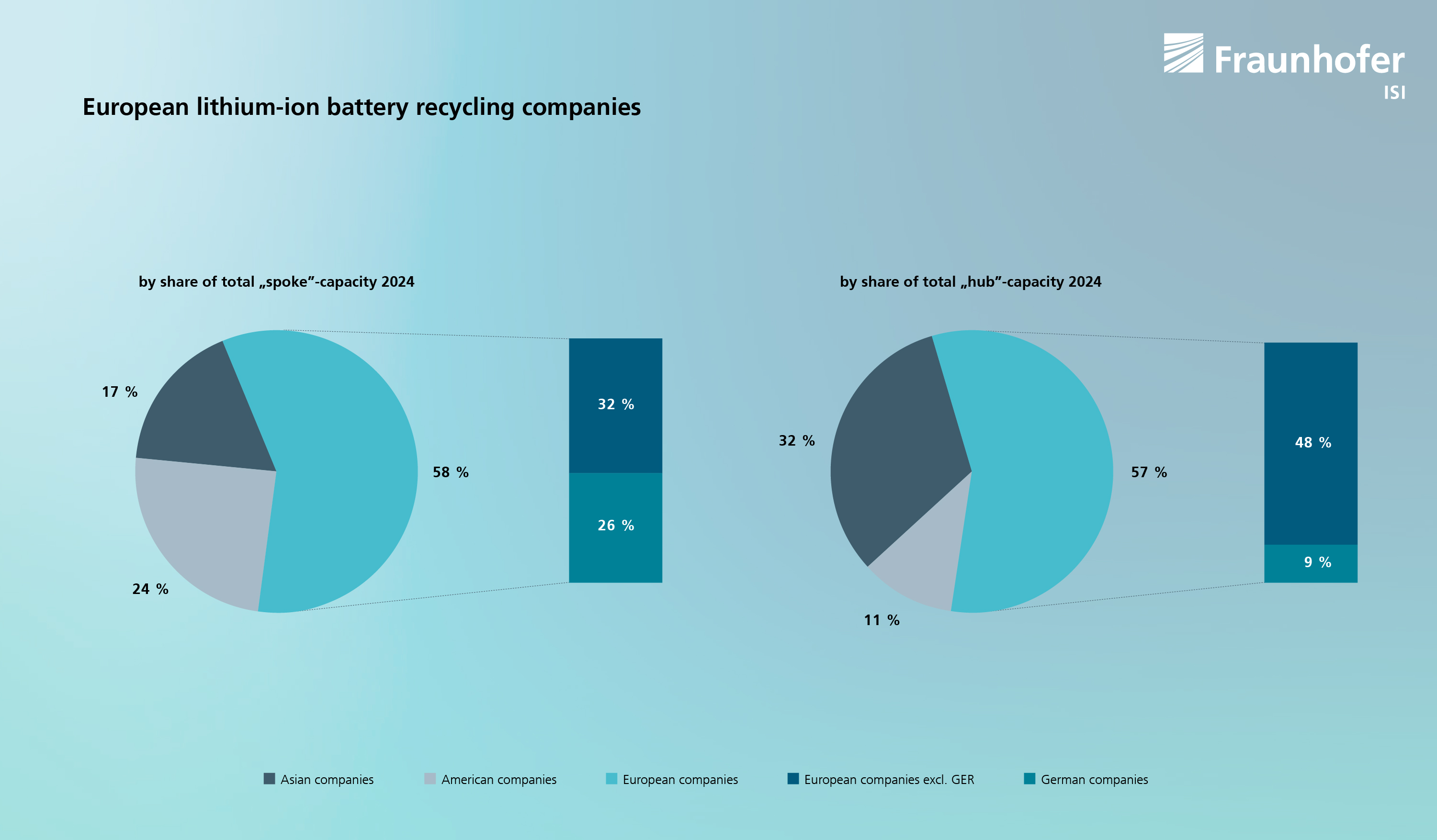

In recent years, European companies have been able to compete with foreign players with new facilities and plant expansions. Currently, around 40 percent of spoke capacities in Europe are provided by Asian and American companies (Figure 3). In 2023, the share was still around 30 percent. SungEel from South Korea and the American company Ecobat operate the largest facilities here. It is interesting to note that around a quarter of European spoke capacities come from German companies. In terms of hub capacity, Asian and American companies account for around 45 percent of total capacity. Here again, SungEel and Ecobat operate the largest plants, followed by Altilium Metals and BASF as European players in the market.

European companies such as Northvolt (Hydrovolt), Altilium Metals and Librec have expanded their capacity announcements. Northvolt itself plans to increase its capacity by several 100,000 tonnes per year until 2030. However, current news such as that regarding Northvolt could delay or reduce this and other capacity expansions for several years. Overall, it is likely that the current proportions will remain the same, as new sites occur (e.g. entry of EcoNiLi in Spain) or Asian companies (e.g. SungEel in Germany, Poland and Hungary) as well as European companies such as Glencore in Italy, BASF in Spain and Tozero in Germany intend to increase their capacities in the coming years through expansions.

In conclusion, the construction and expansion of recycling plants for LIB recycling is currently developing very dynamically and strong growth in both the required capacities and the number of plants can also be expected in the coming years. With the projected return volume, the actual recycling capacity and real treatment in Europe is expected to approach the input streams.

The data used in this article comes from the BEMA2020 (grant number 03XP0272B) and BETSY (grant number 03XP0540B) research projects, which are funded by the German Federal Ministry of Education and Research.