Will the development of a European battery ecosystem fail due to a shortage of skilled labour?

According to media reports, the impending cuts to German battery research could have a drastic impact on the competitiveness of the German and thus European battery industry - because this could further increase the already noticeable shortage of skilled labour and scientific experts. In this article innovation researchers from Fraunhofer ISI explain what is at stake and emphasise that the budget for research and development should actually be increased rather than cut. After all, the upcoming market ramp-up in electric mobility by 2030 will create an enormous need for battery expert knowledge.

The ruling of the German Constitutional Court on 15 November 2023 (Climate and Transformation Fund – KTF ruling) already at the end of 2023 raised questions about the sustainable use of financial resources in times of large transformations – such as the energy and transport transition – and limited resources. With the current cuts in KTF funding for "measures for the further development of electric mobility", particularly in the field of battery research in Germany, there are fears that the loss of academic education could massively increase the shortage of skilled workers and jeopardise the quality of battery expert knowledge. The development of younger scientists in particular is seen as being jeopardised, while at the same time the risk of battery researchers which could emigrate is growing.1

This could therefore threaten the development of a European battery ecosystem, as recent studies have shown that the shortage of skilled workers has become the biggest barrier to innovation in companies, even ahead of the barrier of high innovation costs for companies.2,3

How many battery researchers do we have in Germany and Europe?

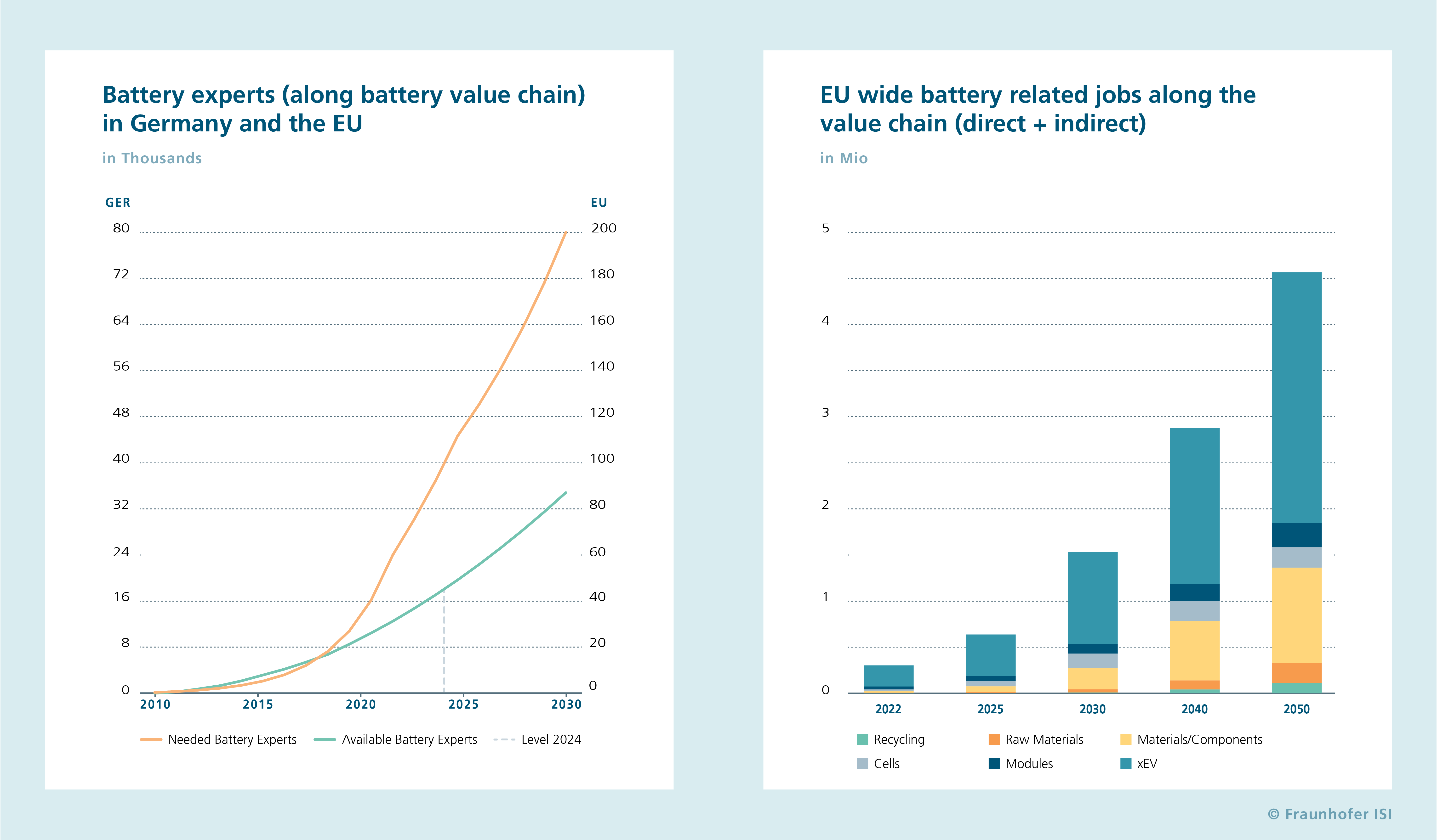

Since the active start of battery research funding, especially for electric mobility, the number of battery researchers in Europe has risen from a few hundred before 2010 to an estimated 30,000-40,000 today. In Germany alone, around 15,000 have been educated.

This enormous increase has been made possible to a large extent by public research funding projects over the last 15 years. Bachelor's, master's and doctoral theses, which are largely the result of funded research projects at universities, technical colleges, research and technology organisations and in cooperation with industry, have helped to create a community and a network in Germany and Europe in which young scientists from the "early days" are now training the next generation of battery researchers at university chairs. This has created a veritable pipeline of experts in battery research.

If investment in battery research and thus in the education of academic experts continues at the current level, their share of the industrial labour market could double by 2030. Without research funding, our calculations show that the number of battery experts would develop much more slowly or even stagnate.

How large is the demand for battery researchers in Germany and Europe?

There is a need for battery experts, especially in the area of research & development (R&D) at companies along the battery value chain, but also in production (in total, about one in ten jobs requires relevant battery experience).4,5

The European battery industry is in a decisive ramp-up phase since 2020 and will remain so until at least 2030 – in terms of market demand, production and thus also the need for skilled labour. The latter has already reached 40,000-60,000 in the EU-wide industry in recent years and will rise to around 200,000 by 2030. Companies are already desperately looking for battery experts, as not all applicant profiles match the job requirements – but there is practically universal demand for electrochemists.

Even based on the current level of R&D activities and the associated education of scientists, an increasing skills gap would arise by 2030 and beyond and only half of the required positions could be filled (figure). R&D by battery researchers would therefore even have to be intensified in order to meet the demand. Due to the burden of the high investment costs in production infrastructure, the industry can certainly hardly bear the training and education costs for people with relevant battery knowledge on its own - therefore, public R&D funding or research beyond industrial R&D activities would have to be maintained at least at the current level or even doubled in the coming years. Only after 2030 could the battery industry in Europe have reached a critical size at best, with which it can successively take over both the R&D tasks for commercialisation-related battery technologies and the training of skilled workers itself.

The need for a skilled workforce is significantly larger and not limited to R&D

Looking at the entire value chain (including battery system integration in electric cars/applications) as well as indirect employment effects, up to 800,000 jobs6 across the EU will be linked to the battery value chain by 2025, even beyond battery researchers. However, the majority of these employees are not "highly educated" battery experts. They are non-R&D employees, such as personnel who can be trained, reskilled or upskilled at production facilities in a shorter period of time, as well as personnel in areas such as service, logistics, sales, etc. Battery experts act as multipliers in training, re- and upskilling for this enormous general need for a skilled workforce. Without them, the knowledge relevant to competition cannot be passed on and the industry-related development of next-generation technologies cannot take place. According to this logic, battery researchers have an enormous leverage effect with a factor of 10.

In recent years, more and more training programmes have therefore been developed for the industry, which is also important, as such a leverage effect will also require an increasing need for training to re- and upskill this workforce.7,8

Looking at all steps of the battery value chain,9 there will even be a need for training, re- and upskilling measures of up to around 1.5 million employees across the EU by 2030. If a battery ecosystem is successfully established in Europe, 4-5 million jobs will be associated with this in the long term (figure).

What does Germany contribute to European battery research?

Battery research in Germany has been massively expanded in the last 15 years, so that around 4 out of 10 battery publications in Europe come from Germany. Around 4 out of 10 battery researchers have been and are being educated in Germany. But the production capacity of the local industry and demand for battery experts also roughly corresponds to this factor. Germany therefore also has a correspondingly large influence on the competitiveness of an emerging battery ecosystem in Europe.

However, specialisation in certain areas of the battery value chain in individual countries and regions in Europe is likely and necessary, which is why it cannot be assumed that the demand for skilled workers will be evenly distributed. Rather, hotspots and regions are emerging (e.g. in the area of raw material extraction in Scandinavian countries).

What is the scope, level and necessity of German and European research and development?

Since the education in the context of bachelor's, master's and doctoral theses is generally financed via funded projects, which then result in publications,10,11 it is also possible to draw conclusions about past and future R&D investments and funding.

R&D expenditures on battery technology development have increased significantly in recent years and are currently estimated at around €1.5 billion per year in Europe and around €500-600 million (around 40%) in Germany. Around 10% of funding in the EU28 member states is covered by EU research programmes and has been at a level of over €100 million per year in recent years. In Germany, the BMBF with 20% to currently almost 30% and the DFG with 17-18% as well as EU research projects from which German researchers benefit with around 10% are the most important funding sources and account for around 50% of research funding (excluding e.g. IPCEIs of the BMWK). The other 50% of funding comes from other federal ministries, regional funding, foundations, in-house research funding from universities, non-university institutions and industry's own R&D as well as collaborations with other EU countries and regions of the world outside the EU.

As a recent study shows,12 in addition to Germany and the EU, also other countries such as Japan, Korea, the USA and China have significantly increased their public funding for research and development in recent years. In some cases, funding has doubled or even tripled for these countries compared to the situation before 2020.

In order to keep up with this competition in the international battery industry, increasing R&D expenditure is required in the EU, which can be realised through private and public investment (i.e. research funding). The added value of public funding to date lies in focussing research on a lower TRL (Technology Readiness Level) and in the transfer to industry. Coordination and division of labour with industry as well as networking are central to the exchange of research results and the understanding of further research needs. At the same time, battery researchers are already becoming accessible to industry and are often taken on by industries directly via these networks.

Industry alone can and must certainly take on a large proportion of R&D investments in the future, but it cannot take on the education, networking and full research of next-generation technologies alone. This innovation pipeline lies within the scientific apparatus and should therefore be publicly funded.

Even if public funding is therefore not needed permanently to this current extent, it is extremely important precisely in this dynamic and critical ramp-up phase - especially still in the next 5-10 years - and thus for establishing and maintaining competitiveness and building a competitive EU battery ecosystem.

In addition to research on scaling for current technologies, important topics include the preparation of future generations of battery technologies with potential improvements in terms of sustainability, security of supply of raw materials and technological sovereignty. For this reason, there should be ongoing R&D on technologies in the lower TRL range and a connection to higher TRLs in the coming years. The requirements for battery experts and thus their education are also changing: an understanding and knowledge in the areas of scaling research, sustainability research, digitalisation and data analysis, recycling research including design for recycling, business models, thinking in more complex contexts and at interfaces to corresponding other disciplines requires an increasingly intensive exchange and networking.

This certainly also requires adapted or new instruments in research funding itself in order to achieve these qualitative and quantitative targets.

To summarise, we conclude from these findings:

There is a large gap between supply and demand for skilled workers of all kinds for the battery industry in Europe - there will be a shortage of 100,000 battery experts in 2030 if investment remains the same - which is why R&D programmes should not only be maintained in terms of educating battery researchers, but should even be further expanded during this period.

However, industry must also make its contribution. Today, a great deal of support is still needed for R&D and the transfer of technologies close to commercialisation. In future, it would be conceivable to focus publicly funded R&D on technologies in the lower TRL range.

Based on the results of the study, we estimate that for every €100,000-250,000 of funding, one highly trained battery specialist will be made available to the labour market in the long term. Including the leverage effects and multiplier function of the battery experts, every €10,000-25,000 would secure one job in a key future industry. Consequently, the continuation or necessary expansion of battery research in the coming years represents an essential and important investment in the future of European industry.

Notes

- Media articles (01/2023): https://www.electrive.net/2024/01/15/neuplanung-des-ktf-verliert-deutschland-seine-emobility-forschung;https://background.tagesspiegel.de/mobilitaet/rwth-aachen-warnt-vor-ende-von-foerderung-von-batterieforschung;https://table.media/research/analyse/batterieforschung-180-millionen-weniger-fuer-neue-projekte/;https://www.fr.de/wirtschaft/batterieforschung-kuerzungen-180-millionen-weniger-tbl-zr-92786583.html;https://industrieanzeiger.industrie.de/news/rwth-pem-kuerzungen-batterieforschungsfoerderungsieht-industriestandort-verkehrswende-in-gefahr/

- J. Horbach, C. Rammer (ZEW 2020), Labor shortage and innovation.

- Kroll, H.; Berghäuser, H.; Blind, K.; Neuhäusler, P.; Scheifele, F.; Thielmann, A.; Wydra, S. (2022): Schlüsseltechnologien. Studien zum deutschen Innovationssystem. Berlin: EFI.

- Thielmann et al. (2021): Future expert needs in the battery sector. Study for EIT Raw Materials

- Thielmann et al. (2024): Battery Skills and Education Report to be published.

- Šefčovič (2021): press conference following the 5th high-level meeting of the European Battery Alliance.

- R. Dominko, D. Maleka, A. Thielmann (2020): Batteries Europe Position Paper of the Task Force Education & Skills.

- Thielmann (2023): Overview of the skills-building challenges in the battery value chain. European Sustainable Energy Week (EUSEW) 20-22 June 2023.

- Equippment manufacturing is included in all steps of the value chain

- Therefore, (peer-reviewed) publications as the output of academic education can also be used to draw conclusions about the funding. Around 2 publications per million euros of funding volume can be identified in Europe and Germany (if the area is understood more broadly than lithium-ion batteries and non-peer-reviewed publications are also included, the factor is larger and may be up to 5). The added value lies far beyond the number of publications in the development of knowledge through people, networking, etc.

- The calculations and estimates were carried out in the Web of Science (WoS), results were compared and validated with data on actual research funding, market data, cost models, studies by Fraunhofer ISI, such as C. Endo, T. Kaufmann, R. Schmuch, A. Thielmann (2024), Benchmarking International Battery Policies - A cross analysis of international public battery strategies focusing on Germany, EU, USA, South Korea, Japan and China, Fraunhofer ISI, Karlsruhe, January 2024.

- C. Endo, T. Kaufmann, R. Schmuch, A. Thielmann (2024), Benchmarking International Battery Policies - A cross analysis of international public battery strategies focusing on Germany, EU, USA, South Korea, Japan and China, Fraunhofer ISI, Karlsruhe, January 2024.

More information

Last modified: